2024 Schedule K-1 – Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust, including income as well as credits, deductions and profits. A K-1 tax form inheritance statement must be . Partnerships have general partners and limited partners. Both types of partners report losses on Schedule K-1. Limited partners are not financially responsible for losses in the company .

2024 Schedule K-1

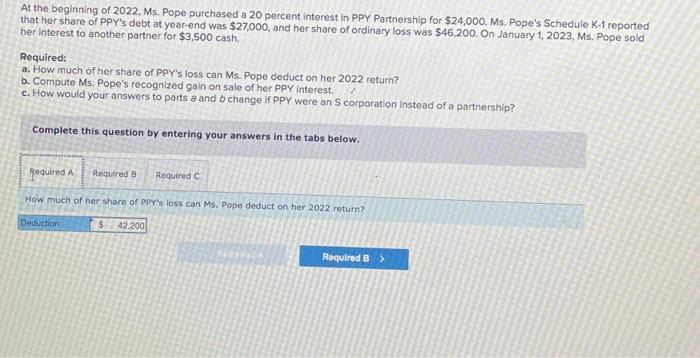

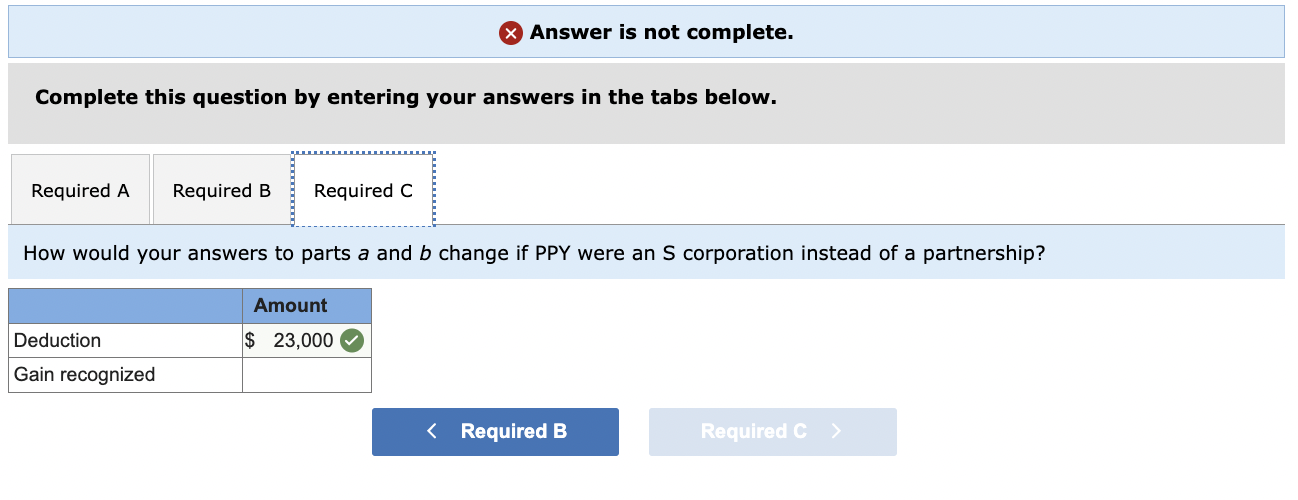

Source : schedule-k-1.pdffiller.comSolved At the beginning of 2022 , Ms. Pope purchased a 20 | Chegg.com

Source : www.chegg.com2023 Form IRS 1041 Schedule K 1 Fill Online, Printable, Fillable

Source : 1041-k-1.pdffiller.comSolved At the beginning of 2022, Ms. Pope purchased a 20 | Chegg.com

Source : www.chegg.comYouth Basketball 2024 Schedules The YMCA of Vincennes

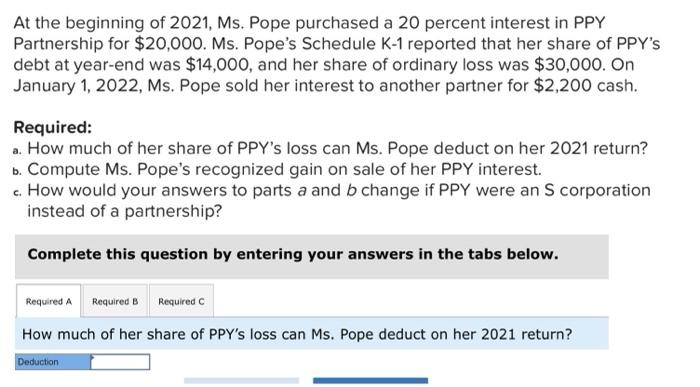

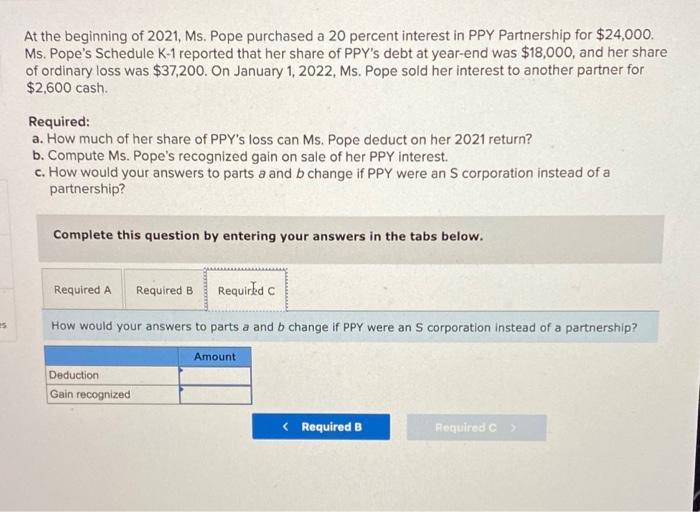

Source : vincennesymca.orgSolved At the beginning of 2021, Ms. Pope purchased a 20 | Chegg.com

Source : www.chegg.comWhat Is Schedule K 1 on H&R Block? | Schedule K 1 Filing

Source : www.youtube.comSolved At the beginning of 2021, Ms. Pope purchased a 20 | Chegg.com

Source : www.chegg.comIRS Instruction 1065 Schedule K 1 2020 2024 Fill out Tax

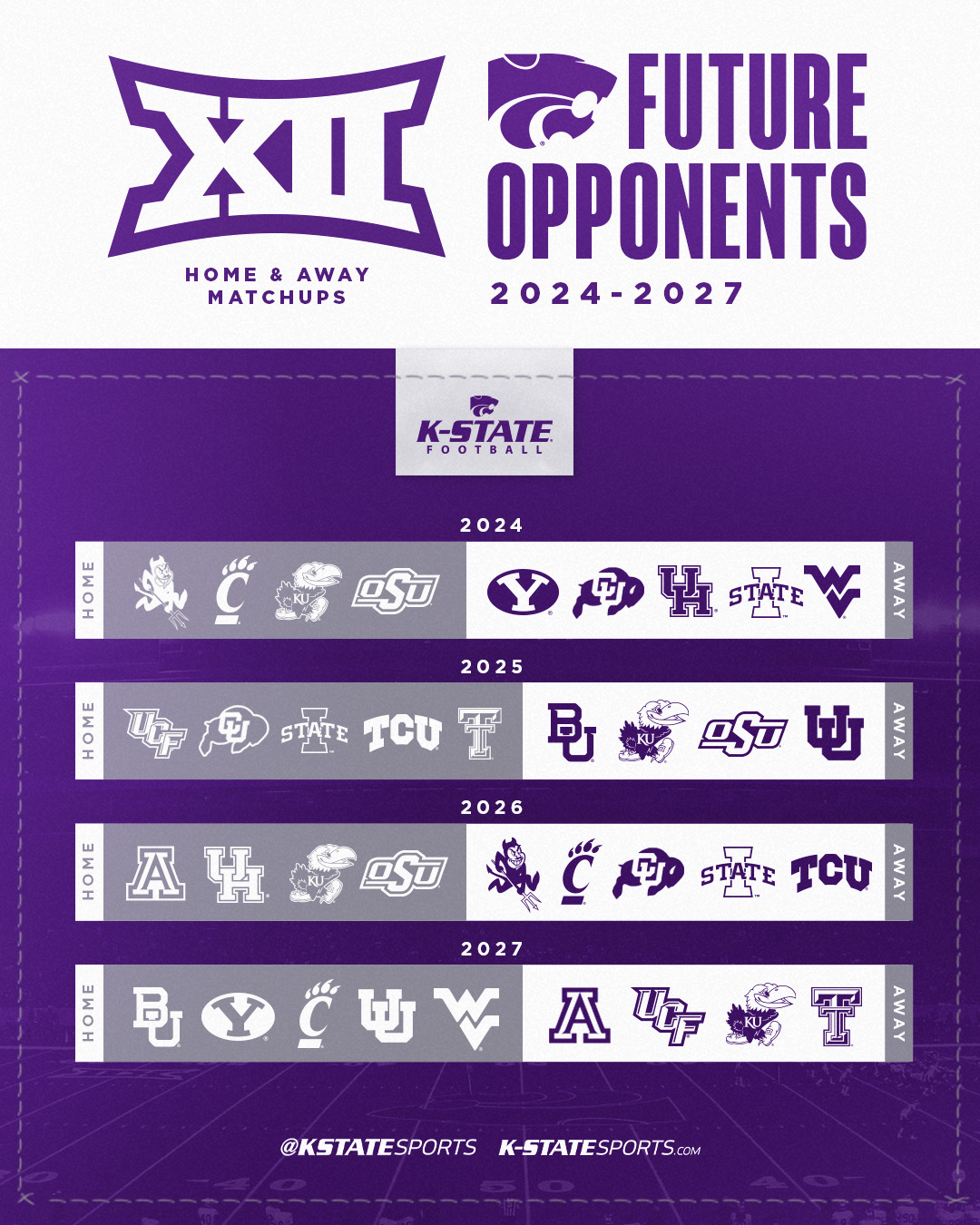

Source : www.uslegalforms.comK State Football on X: “.@Big12Conference schedule through 2027

Source : twitter.com2024 Schedule K-1 2023 Form IRS 1065 Schedule K 1 Fill Online, Printable, Fillable : Schedules K-1 are used to report your share of a corporation’s income, reduced by any taxes paid on income, deductions, credits, etc. It is not a requirement for file Schedule K-1, but it is an . If you run two or more separate businesses, you’ll need to know how to file taxes for each one and how they will impact your personal tax return. • Filing taxes for a business you own may .

]]>