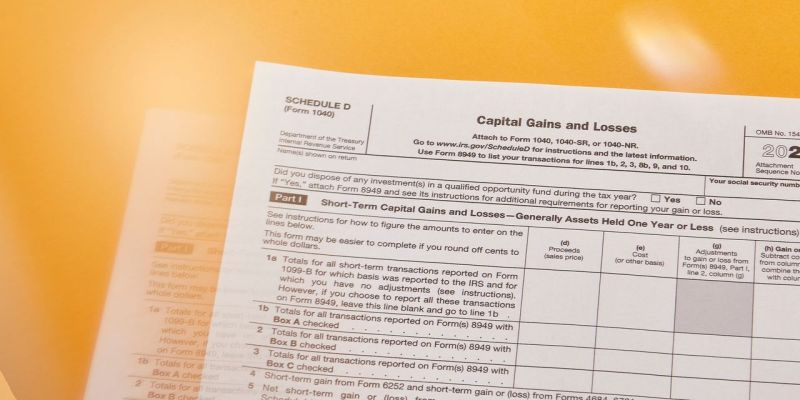

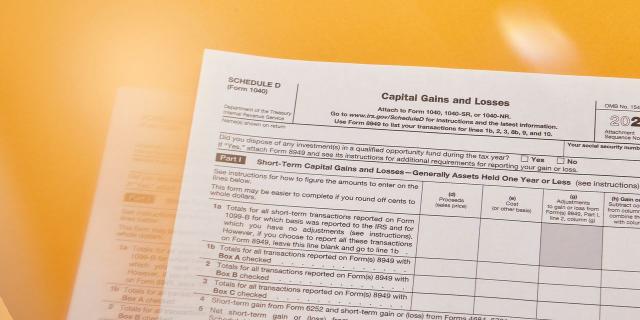

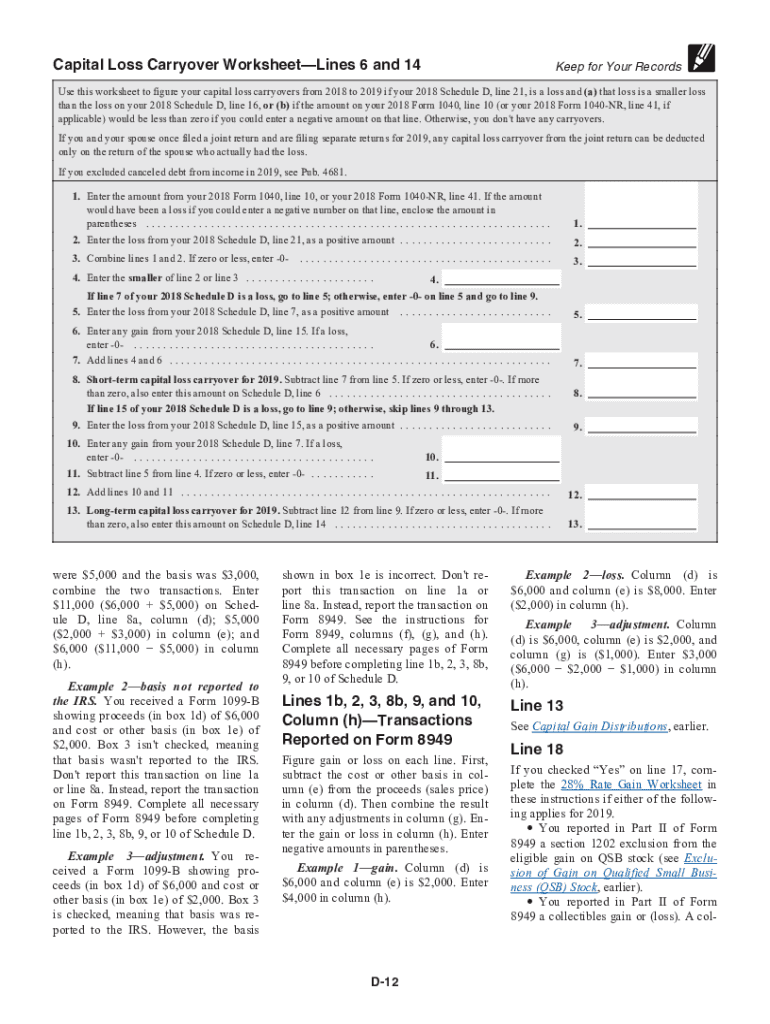

2024 Form 1040 Schedule D Instructions – the IRS writes in its Schedule D instructions. If your business sold a stock, bond or other investment asset, you will receive a 1099-B form with all of the information on the sale from each and . Form 8949, that some taxpayers will have to file along with their Schedule D and 1040 forms. Whenever you sell a capital asset held for personal use at a gain, you need to calculate how much money .

2024 Form 1040 Schedule D Instructions

Source : www.irs.govWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

Source : finance.yahoo.com1040 (2023) | Internal Revenue Service

Source : www.irs.govForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.com1040 (2023) | Internal Revenue Service

Source : www.irs.govWhat Is Schedule D: Capital Gains and Losses?

Source : www.investopedia.comSchedule d tax worksheet: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.govAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comPaul D. Diaz, EA, MBA on LinkedIn: Congress hasn’t made changes to

Source : www.linkedin.com2024 Form 1040 Schedule D Instructions 1040 (2023) | Internal Revenue Service: The instructions for Form 8949 are included spaces at the top portion of Part I and Part II on Schedule D of Form 1040. Form 8949 provides directions at the bottom of the page. . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 .

]]>

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)

:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-bce9771cbe94498ab34d6b9107e208de.png)

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)